Wade is a one-man think tank. Wade’s retirement income framework was the base that helped me build out the RISA®. He is the Professor of Retirement Income at The American College of Financial Services, a higher education institution for financial planners. He leads the curriculum for their Retirement Income Certified Professional designation (RICP®). He is also a partner with me at McLean Asset Management and Retirement Researcher.

He earned a Ph.D. in economics from Princeton University in 2003 and became a CFA charter holder in 2011.

Wade regularly publishes his research on retirement income topics in leading peer-reviewed practitioner-based financial planning research journals.

Alex graduated from George Washington University with a doctorate in Clinical Psychology. During this time, he focused his research efforts on psychometrics and was a research fellow for the National Institutes of Health. He created a questionnaire to assess how your health beliefs affect how you utilize medical services. It was well-received and set him up for an academic career.

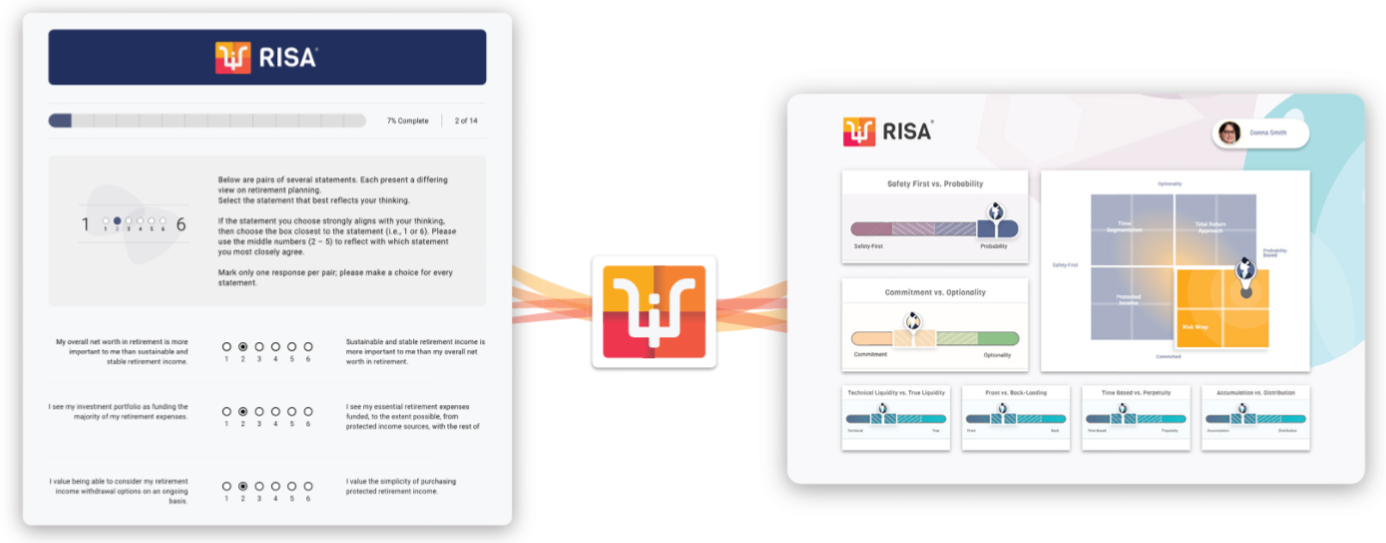

Upon graduating, his research interests evolved to investments, and he sought a formal career in the financial industry. Staying true to his scientist-practitioner mindset, he joined McLean Asset Management and was able to publish a number of articles. Alex also founded a financial planning software company to better serve the industry and their underlying clients. Alex took Dr. Wade Pfau's framework for Retirement Income Planning and sought to quantify his concepts into a workable retirement income model.