Guiding You to the Summit…

…And Back…

Discover more with a macro-economic approach.

Listen to Our Podcast

On the Money Tune-Up Show, Dan educates you on ways to be a good steward of your money by paying attention to topics typically ignored in financial planning.

For many people, working toward financial goals is often focused on taking unnecessary investment risk, which likely will produce disappointing results.

Traditional financial planning focuses on the “above-the-line” possible growth of your money at the expense of ignoring the financial decisions which are subtracting from your wealth building potential. These subtractions have a compounding negative impact.

It is as if your money can potentially grow “above-the-line” with the amount which is being taken away also growing each year. This is one reason it seems to be so hard to get-ahead financially and detracts from your ability to build wealth over a lifetime.

Dan Flanscha with Long’s Peak Financial provides a comprehensive financial plan for every customer. Dan focuses on educating customers about every aspect of financial planning; and he spends considerable time getting to know each customer, their goals and planning needs. Dan treats every customer like a member of his family and we highly recommend his services!

Susan E. Patton & Daniel J. Weller

Client, August 2024

Some financial “contractors” only have one tool: Return on Investment. Dan Flanscha has a whole tool belt full of ways to manage your money.

Jim Murphy

Client, August 2024

Dan Flanscha is the consummate professional dedicated his profession. His passion is to help his clients achieve their financial goals.

Len Golke

Client & Colleague, September 2024

Client testimonials are the personal views of a select group of Longs Peak Financial clients. These clients do not have a financial interest in Longs Peak Financial and were not paid to express these views and have no other interest in or relationship with Longs Peak Financial other than a client relationship. These opinions are not necessarily indicative of future performance or results and may not reflect the experience of all clients.

A macro-economic approach helps you discover:

- How this subtraction occurs.

- How to organize your finances for efficiency.

- How to test your financial decisions to determine if they are going to help or hurt you.

- How to put you in a more flexible position to potentially gain more control.

This approach also allows you to see how financial decisions can affect your financial well-being over time.

Take the RISA Retirement Assessment today!

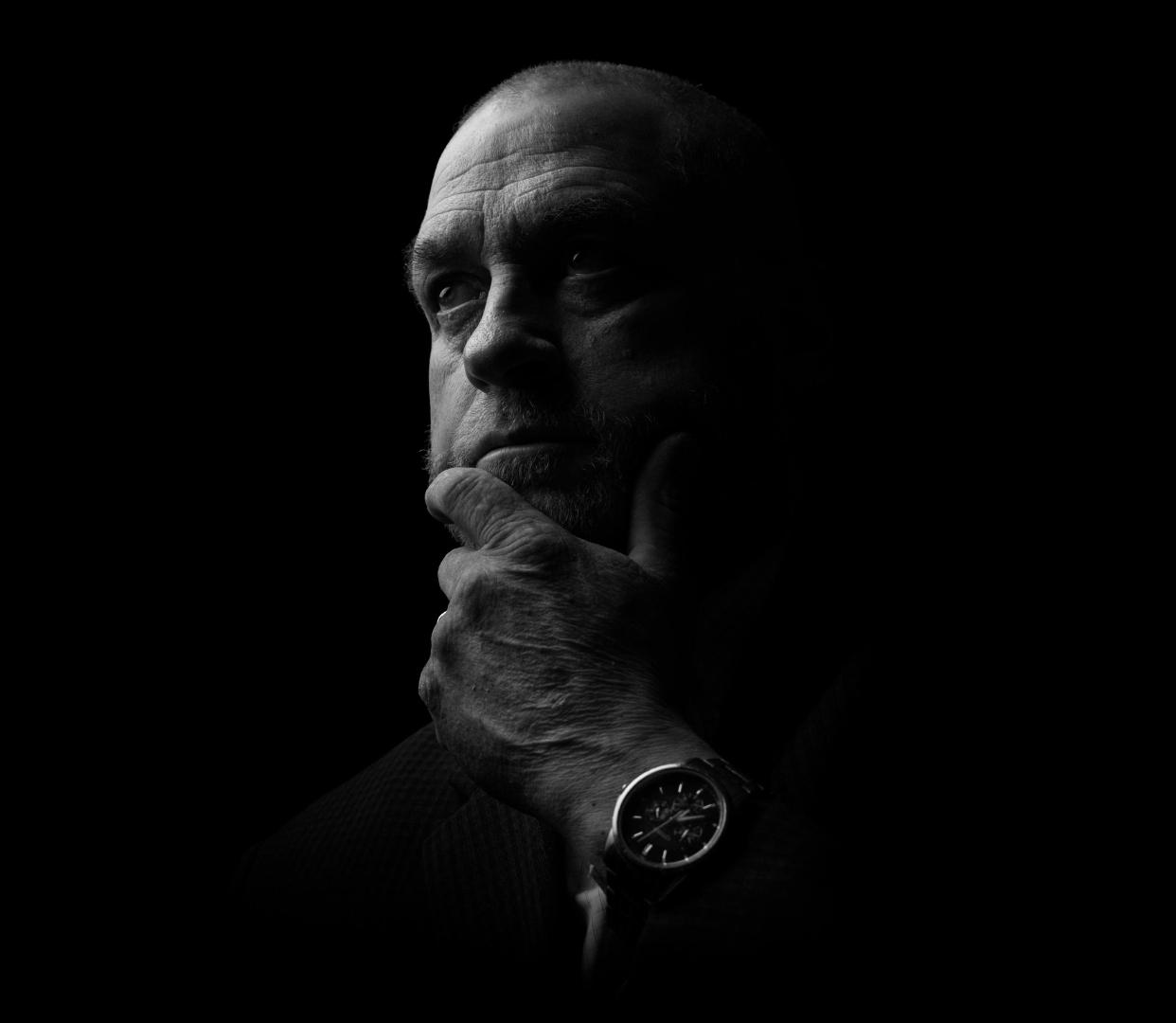

Meet Dan Flanscha

Daniel, CFP®, CLU, ChFC, RICP has been in financial services for over 35 years. He started in the industry following graduation from Iowa State University where he received a Bachelor of Science degree to teach. Across the country he has served people with personal financial planning, retirement, business and estate preservation planning. He worked with a Fortune 500 company for 21 years serving in a variety of roles including a position among the top 100 leaders.

Throughout his career, Dan has been a part of the planning process for thousands of families.

Why work with Long’s Peak Financial?

The financial world tends to focus primarily on seeking investment rates of return. Although investments may be a part of your financial strategy this cannot be the primary focus. Because so much emphasis is focused on seeking high rates of return, seeking efficiencies is ignored with traditional financial planning strategies.